Table of Content

We maintain policies about the proper physical security of workplaces and records. Our physical, electronic, and procedural safeguards comply with government-mandated regulations on Internet banking security and the protection of customer information. When outside parties perform services on our behalf, in some instances, we may disclose some or all of the information that we collect, as described in the Information Collection section. This information may be provided to certain non-financial companies and independent contractors for the purposes of servicing your account or to perform marketing or similar services on our behalf with respect to products or services we provide.

Our OTP allows you to safely transfer funds outside your own accounts; to family, friends and to settle expenses. Safety starts with understanding how developers collect and share your data. Data privacy and security practices may vary based on your use, region, and age. Avail overdraft facility with minimal documentation basis banking transaction with no financial documents requirement. These accounts are used for keeping the secuties provided as margin with exchanges.

hogy 2019. szeptember 14-től változik a CIB Internet Bankban használható

These companies and contractors are subject to confidentiality provisions and restrictions that prohibit using the information beyond the performance of the specified services on our behalf. The information we maintain about your customer relationship helps us identify you and helps prevent unauthorized persons from accessing your information, or your accounts or services. We offer a plan that gives you and your family access to the highest quality healthcare services. Supported by a mobile application that brings you closer to all the services you need.

Every product or service we offer is designed to reflect the ways our customers actually use their accounts. This is the reason why we collect, and analyze information about customer activity and history, and how we tailor new types of Banking products to meet your needs. Online Banking Enjoy exclusive digital banking services like a daily online transfer limit of up to EGP 2 million - the highest in the market. CIB is Egypt’s leading private-sector bank, offering a full range of financial products and services to enterprises of all sizes, institutions, households, and individuals.

Discover an easier banking #withCIB!

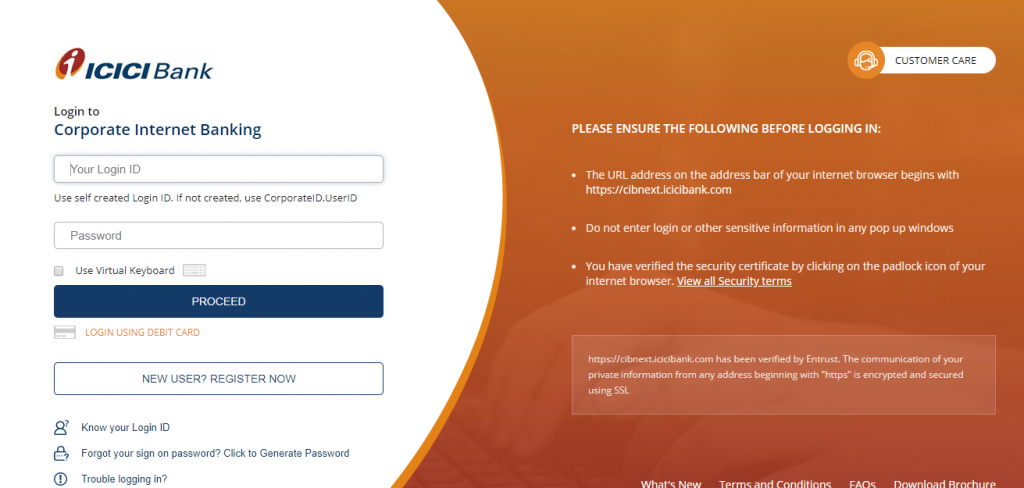

With CIB, you can dramatically cut your paperwork and enjoy the triple benefits of 'efficiency, ease of use and economy'. ICICI Bank has won the award for the "Best Corporate /Institutional Internet Bank", as judged by Global Finance Magazine, USA for three consecutive years, 2004, 2005, 2006. ICICI Bank's Corporate Internet Banking is a one stop shop for all your online banking needs. It gives you the power to execute critical bank transactions instantly with no time lags and is an indispensable tool in today's 24 x 7 high-speed business world. If the User uses both the CIB Internet Bank and/or the CIB Bank Online services, logging in to the systems takes place with identical user identification. The signature code used for approving operations that require signature is the same in the case of WithKEY Token-based identification as well.

SWIFT India, a joint venture between Swift Global and 11 local banks, established specifically to provide messaging service to the Indian financial markets community, with the approval of the Reserve Bank of India. As part of correspondent banking, ICICI Bank, India offers Rupee account to foreign banks. A specialized account for payments to merchants for online purchase of goods and services.

Easy Token

Prior to logging in to CIB Internet Bank - When using Token Authentication Method - you need to provide a 4-digit PIN code generated by you to use the Token Tool to protect your Token device. Please note that the security degree of the Internet Bank is still adequate, and therefore we recommend that you allow access to the application in the warning and then access our CIB Internet Banking service. By understanding your relationship, we can better meet your needs and determine your eligibility for other Bank of Alexandria services that could be of value to you. We will maintain security standards and procedures designed to protect customer information. We will continue to test and enhance our technology with timely updates to improve the protection of our information about you. Requires less fees and charges compared to manual transactions through the branches.

Information about your transactions or experiences with the various business units of our Bank. Information you provide to us in applications or forms of our Bank including those collected now or in the future in our web pages. Seamless integration of Pre-trade, At-trade and Post–trade services under one roof.

Some banking options are still not available in this app or the new online interface, so opening the very old Java client on a desktop computer is still required sometimes, but for daily tasks this app works perfectly. Perform easily your payments by scanning the QR code or generate your own QR and receive money, in a tap. INR Vostro account As part of correspondent banking, ICICI Bank, India offers Rupee account to foreign banks. Our Debt Syndication Desk offers end-to-end services related to the origination and placement of bonds & commercial papers across various Issuer and Investor segments.

For mergers and acquisitions; Exit Offers-Delisting & Open Offer, InvIT, REIT & Buybacks and other complex transactions. Facilitates clearing, settlement & related services for G-Sec and T-bill. Supplying physical Gold/Silver to Bullion traders and jewellery manufacturers by way of Outright sale and Gold Metal Loan products. Cater to all the Escrow Account requirements such as Sale purchase transactions, Real estate debt transactions, etc. LO/BO/PO, NRO Accounts, Foreign Currency Account, Special non rupee resident account .

Facilities are available to customer in this accounts without limitation on transactions like Cash deposit/withdrawal, cheque book, fund transfer, online banking etc. The CIB Hard Token can be used after entering the personal 4-digit code set by the user at the time of the request. ICICI Bank' Corporate Internet Banking is a one stop shop for all your online banking needs. It gives you the power to execute critical bank transactions instantly from your office locations with no time lags and hence is an indispensable tool in today's 24 x 7 high-speed business world.

Take care of your everyday banking needs more easily, with greater freedom and customisation using our digital services. As long as you keep your user ID and password / Token PIN secret, others will not have access to your data. Keep it secret and make sure that no one is watching your password or Token PIN code and code. Once connected to CIB Internet Bank, it is already in a secure environment, provided by the worldwide security technologies .

CIB is Egypt’s leading private sector bank, signed a financing agreement with Arabian Construction Company with a loan facility of EGP 3 billion or their equivalent in foreign currencies. On the phone For support, including emergencies such as cards closure or immediate critical feedback. We understand your desire to guarantee the best education experience for your child. Therefore, we offer the Graduation plan, which will help you prepare for one of the most treasured moments in your life and your child's life.

We update and test our technology on a regular basis in order to improve the protection of customer information. Information we receive from you on applications or forms, which may include information such as your name and address, among other information. Information will be disclosed as warranted by the laws of the Republic of Egypt including banking rules and regulations. Your customer information allows us to respond quickly and efficiently to your needs. More efficient and timesaving as it allows you to finish your transactions anywhere, at any time without your physical presence. Safer, and helps eliminate the risk of theft or data leakage during manual transactions.

To succeed in this endeavor, we collect customer information that becomes the cornerstone of our ability to provide superior service to you when you need it. We are committed to bringing you the products and services that you need to succeed financially. To join the service, please fill the CIB Business Online service interactive applicationsign it and submit it to your nearest branch or your relationship manager, along with a copy of your National ID and the required documents. We will contact you to activate the service and help you set up your system. Authorize your online transactions with a one-time code for an extra layer of security.

No comments:

Post a Comment